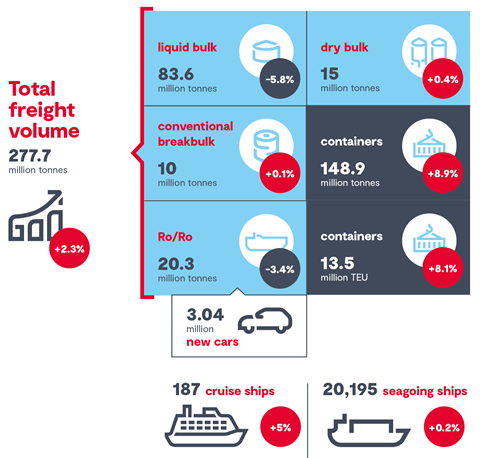

At 278 million tonnes, the port of Antwerp-Bruges witnessed total throughput growth of 2.3 percent in 2024. Conventional breakbulk stood at 10 million tonnes (up 0.1 percent on 2023), meanwhile ro-ro figures sat at 20.3 million tonnes (down 3.4 percent on the previous year).

This comes against the backdrop of continued geopolitical uncertainty, whether it be disruptions in the Red Sea, Russia’s sustained invasion of Ukraine, or the change of leadership in the USA.

Total freight volume at the port of Antwerp-Bruges was up 2.3 percent to 277.7 million tonnes, with containers increasing by 8.9 percent and making up more than half of this at 148.9 million and 13.5 million (up 8.1 percent) in terms of teu. With liquid bulk figures down 5.8 percent on 2023 at 83.6 million tonnes, dry bulk (15 million tonnes) saw a marginal gain of 0.4 percent.

Jacques Vandermeiren, ceo of the port of Antwerp-Bruges, emphasised the need for collaboration both in terms of cross-border and cross-industry relations, as well as the incorporation of new technologies to assist in efficient operations.

Geopolitical challenges were central to the discussion, with Vandermeiren pointing to the war in Ukraine and the restrictions on shipping within the Red Sea. He noted the knock-on effect of Russia no longer providing large proportions of gas to the European continent, with this now predominantly coming from the USA and Qatar. The ceo also noted how Russia was a key export route for Antwerp-Bruges prior to its invasion of Ukraine in 2022.

HLPFI has detailed the knock-on effect of the Red Sea crisis as it has happened, and the impact it has had on the shipping and logistics industries is clear to see, with Vandermeiren suggesting that “two to three weeks” are added onto journeys as shipping lines have continue re-routing around the African continent as opposed to using the Suez Canal.

Another crucial geopolitical factor is the return of Donald Trump as president of the USA. “It is interesting to see how high the tariff wall will be” in the coming months, Vandermeiren said. For the port of Antwerp-Bruges, the USA is its second largest trade partner, making up 10 percent of its business. “We can expect tariffs… We will see what sort of deal we can expect [to make] with his [Trump’s] administration,” he added.

China (6 percent) is third only to the aforementioned USA and the UK (top, with 11 percent) when it comes to key markets for Antwerp-Bruges. Labelling the former as “the warehouse of the world”, Vandermeiren believes that more transparency and trust is needed and observed that Europe is seemingly struggling to deal with China.

Although Antwerp-Bruges has a presence at other ports globally – such as in Benin, Brazil, Namibia and Oman – the port’s ceo is concerned that industries are being moved from Europe to other continents. Within this, he acknowledges that the increase in regulation has played a big role in businesses taking their production – and trade – elsewhere.

Vandermeiren claimed that the port is one that is in transition, citing the introduction of shore power; heat and steam networks; charging hubs for electric trucks and green corridors for trucks between ports; a green fleet; as well as multifuel ports. On the last point, the ceo claimed that there was “no silver bullet” as of now, listing the likes of ammonia, methanol and LNG as interchangeable.

Despite the port of Antwerp-Bruges seeing growth for the first time in three years, the message remained clear – that collaboration and openness are absolute musts, especially when there is so much uncertainty on a global scale.