The recent wildfires that wreaked havoc across Los Angeles are expected to drive up import demand for bulk and breakbulk commodities, according to shipping sector analyst Drewry.

Drewry said that in addition to increased bulk and breakbulk cargo imports, export numbers could take a hit. Rebuilding the region will aid the need for construction materials, generating demand for bulk and multipurpose shipping. It cited data from AccuWeather, which puts the cost of the disaster at USD250-275 billion. The region will need massive reconstructions, which will increase cargo imports considerably at the West Coast of the US, especially at the Los Angeles and Long Beach ports.

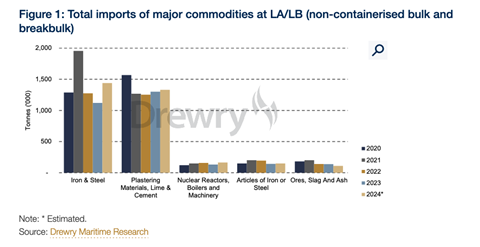

Looking specifically at non-containerised general cargo and project cargo import at both Los Angeles and Long Beach over the past five years (figure 1), Drewry said the imported commodities are iron and steel, plastering materials, lime and cement, nuclear reactors and machinery. While exports are likely to contract, imports are set to rise as reconstruction activities ramp up.

Imports of construction materials account for 25 percent of the total seaborne imports of non-containerised goods (excluding liquid bulk and ro-ro cargo), said Drewry. Additionally, it noted that president Donald Trump’s plan to impose a 25 percent tariff on imports from Canada and Mexico, starting 1 February, will inflate import costs.

Drewry also suggested that the reconstruction activities will impact exports from these regions, as domestic consumption will increase and limit the potential for exports. The most exported commodities during this period were ores, steel products, other construction materials and oil seeds. While the total exports of forest products and timber from these ports account for 1.5 percent of total seaborne exports of non-containerised goods (excluding liquid bulk and ro-ro), the sheer volume of these exports makes them significant. Their destinations are typically distant countries, making this a long-voyage trade.

Moreover, the wildfires have disrupted transportation networks, resulting in road closures and detours that hinder trucking operations and complicate supply chain continuity. High winds have exacerbated the situation by heightening the risk of broader disruptions. Transportation services are experiencing interruptions leading to delivery delays and logistical challenges.

“We anticipate difficulties for exports and imports due to logistical challenges and the need for reconstruction work,” the analyst summarised. “Imports of construction materials will surge, while exports of timber and forest products are likely to face obstacles. Key countries such as China, Japan, and South Korea may face challenges related to timber imports. In contrast, Canada, Vietnam, and Mexico will need to ramp up production to meet the increasing demand for construction materials during the rebuilding phase.”