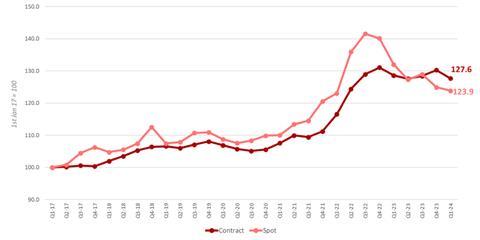

The European road freight rate benchmark – produced by Transport Intelligence, Upply and the International Road Transport Union (IRU) – shows that rates fell in both the spot and contract markets in Q1 2024. However, there are signs that rates could be starting to normalise.

The spot rate index was down 8.2 points year on year in Q1 2024. Meanwhile, falls in the contract rates index have slowed, down 1.0 point year on year.

Compared to Q4 2023, the contract index dropped 2.6 points to 127.6. The spot index fell to 123.9 points after a more modest 1.1-point fall quarter-on-quarter.

“Low demand continues to push spot rates down; however, the magnitude of spot rate declines is decreasing. This may indicate a less negative demand environment that could lead to rate normalisation,” the report said.

Demand pressure is expected to continue on a slight upward trajectory. March’s 2.4 percent European inflation rate was the lowest in 33 months and produced a 0.6-point growth in consumer confidence, according to consultancy McKinsey. “The more stable demand picture reflected by these indicators has prevented extreme drops in spot rates,” the report added.

The implementation of Directive (EU) 2022/362 amending the Eurovignette Directive among EU Member States is still under way and is adding upward pressure on heavy transport rates (notably in Germany). Moreover, CO2-based tolling came into effect in Austria and Hungary in January and the Czech Republic in March, pushing up rates in those markets. These changes resulted in a toll increase of 7.4 percent for Austria, 40 percent for Hungary and 13 percent for Czech Republic, according to the companies in charge of toll management in these various countries.

Other operating costs, such as vehicle maintenance, insurance, and tyre costs, remain elevated compared to previous years, keeping cost and contract prices high.

Diesel prices, meanwhile, have fallen across Europe from their highs last year, easing some supply-side pressure. However, after the continuous falls seen in Q4 2023, diesel prices have been modestly rising since the beginning of the year: average diesel price at pump in Europe are up 3 percent at the end of Q1 2024 versus beginning of January 2024.

Michael Clover, Ti’s head of commercial development, said: “Though road freight rates fell again in Q1 2024, the expectation is that rates will pick up again through 2024. Costs are stubbornly high and we may well be moving into another challenging supply chain period, with indicators suggesting import volumes are recovering and supply chain bottlenecks, which have recently been masked by low volumes, becoming more acute again.

“That represents a bad combination for capacity which will filter into the road freight market over Q2 and Q3 and is likely to apply upward pressure to rates.”