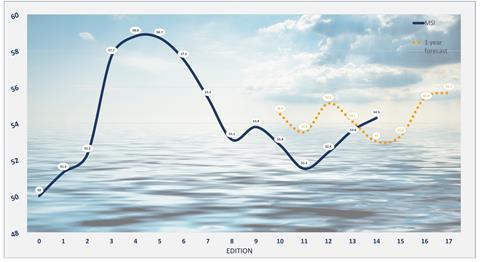

The 14th edition of One World Shipbrokers’ Market Sentiment Index (MSI), published in August, showed another climb in sentiment for the multipurpose shipping and breakbulk sector – the third consecutive rise in five editions from 53.6 to a level of 54.3 (anything above 50 being classed as positive).

However, it attributed the improvement in market conditions largely to the unfortunate consequences of what is becoming a lengthy war in Gaza and the risk of missile strikes by Houthi rebels in the Gulf of Aden and Red Sea.

This is increasing pressure on fleet capacity; with the additional tonne miles being sailed round the Cape of Good Hope, multipurpose carriers are reporting a tangible tightening.

“Clarksons Research has estimated that the world fleet ‘will have to absorb an extra 3.6 billion tonne miles if the Gaza war continues for the rest of the year’, which would be the second-largest additional tonne-mile growth recorded after the rebound following the global financial crisis in 2010,” said the analyst.

On a more positive note, carriers are reporting that delays to transiting the Panama Canal have been easing throughout the year, which is helping to restore impacted service schedules, although growing optimism about the market has encouraged some operators to voice concerns about current and future availability of tonnage.

“With still very few replacements yet being built, particularly by tonnage providers, and the relentless ageing process of the current worldwide fleet – now at 17.4 years according to DNV in its June 2024 analysis – shippers will have to consider, if they have not already, reining in their vessel age limitations – often at 15 years, and instead opt for well-maintained and well-managed tonnage, since both short and long-term cargo volume expectations are continuing to rise,” said the MSI.

Still, the analysts’ other sub-indices are trending upwards. The short-term operational Index (three to six months) has been steadily climbing, returning to pre-summer 2023 levels, the future index (six to 12 months) continues to climb upwards to a figure of 56.5, reinforcing carriers’ views that the market will continue its current up-cycle.

The MSI report states that without any obvious recent industry stimulus, confidence among the carrier community is improving. It cited, among other factors, the lifting of a long-held onshore wind energy development embargo in the UK as a benefit for the European shortsea trades.

It also believes that the current disruption seen on the container shipping market is unlikely to have a long-lasting effect with rates on all trade routes falling since the mid-summer peak. The steady increase and lower volatility of the Baltic Handysize Index over the course of 2024 is a positive indicator limiting the sector’s need for cross trading. “The signals for the multipurpose sector are good. Freight rates are stable and at sustainable levels. The hope among the carrier community is that there’s a period of relative stability ahead but global geopolitical events including the upcoming U.S. presidential election can and will affect future sentiment,” it said.