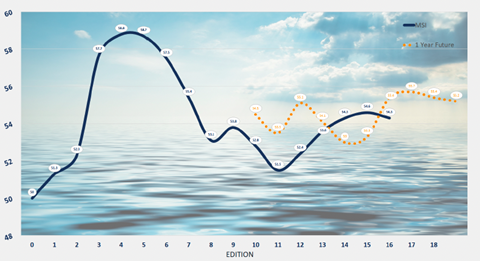

The 16th edition of One World’s Market Sentiment Index (MSI) for the multipurpose and breakbulk shipping sector shows a slight softening in overall carrier sentiment. Protectionist trade policies, shifting global freight dynamics, and geopolitical instability are all dragging on the outlook. Energy markets are a source of optimism but shipping lines are bracing for rate volatility ahead.

The Q1 2025 index stood at 54.3, down from 54.6 in the final quarter of 2024. The analyst said that near-term uncertainty arising of Donald Trump’s return to the White House and the protectionist agenda he aims to implement has set not only multipurpose carriers but governments around the world on edge.

In tandem with falling consumer sentiment in the USA, multipurpose carrier sentiment Stateside has sharply dipped since the Q4 2024 edition, which was published just before the outcome of the US election was known. “Whilst tariffs are perceived to level out the trading landscape, fear of inflation, increased government borrowing to fund tax cuts and the slowing pace of interest rate cuts is undermining US confidence which is trickling down globally.”

A ceasefire in Gaza was heralded as welcome news. The analyst highlighted that the multi-stage ceasefire plan, should it result with a return of ships to the Red Sea and the Suez Canal in the medium term, could see the “false ceiling” supply shortage come to an end.

“The massive buildup of container tonnage that has been hiding in plain sight will precipitate a sharp fall in freight rates. Whilst the multipurpose sector – ageing as it is – has added little additional deadweight to the fleet in recent times, a soft Handy sector as well will challenge for breakbulk cargoes as both container and bulk ships look for additional sources of freight income,” according to the MSI.

Conversely, the MSI highlighted that there are voices doubting that the Red Sea will be safe enough to return to en-masse any time soon and carriers may still choose to maintain longer voyages in the context of crew safety, flag requirements and lower insurance premiums.

The MSI also shone a light on developments in China, noting that Chinese exports (which have grown consistently throughout 2024) reached a year on year high in December ahead of expected US tariffs. This is attributed to overseas buyers racing to replenish inventory. “It remains to be seen whether Trump will be as punitive as some fear, or whether measured strikes on certain industries – such as autos – are meted out. The addition of COSCO to the US Department of Defense’s sanction list won’t have any material effect on their commercial operations, however it is intended as a signal to Beijing that levelling up trading practices is a priority. But with only 177 vessels in the US flag, America depends on the foreign flag fleet to support its economy,” said the analyst.

Considering current opacity, it is unsurprising respondents to this edition of the MSI all note the difficulty in reading the short-term outlook but there remains cautious optimism for later in the year once the new order settles down. ”It’s hard to recall a more difficult time to predict market direction in the wake of what is going on globally,” said one respondent.

Nevertheless, energy markets remain the point around which most respondents remain positive. Despite new headwinds in US renewables developments, the IEA reports that “global renewable capacity is set to grow by 2.7 times by 2030”. But with Mr Trump’s ”drill baby, drill” stance, there is a growing sense that local deregulation will unlock a substantial number of new oil and gas developments.

The forecast for the next edition of the MSI (#17) made a year ago is for a rise to 55.7. “Market conditions would need a catalyst for this to eventuate which would seem improbable in the coming quarter. Therefore, a period of narrow range consolidation is more likely in keeping with current sentiment,” said the analyst.