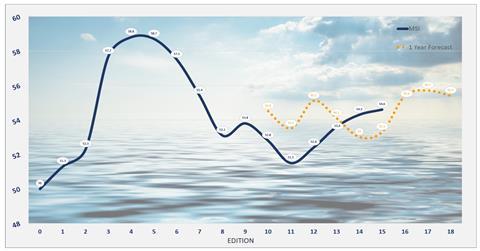

The 15th edition of the One World Market Sentiment Index for the multipurpose and breakbulk shipping market showed a modest increase to a level of in 54.6 in Q4 2024 (54.3 in Q3 2024)

“A resilient summer season has been supported by a surprisingly firm container sector, the lagging effects of additional tonne miles being sailed and improving economic sentiment generally,” according to the index. Interest rate cuts in the USA and the EU have been welcomed by business and the public alike, while a government stimulus package in China bodes well for increasing domestic consumption and bank lending.

Moreover, concerns over a potentially disruptive strike at East and Gulf coast ports in the USA was alleviated quickly.

In terms of headwinds for carriers, Israel’s conflict with its near neighbours continues to have an outsize influence rendering Red Sea and Suez canal passages all but impossible. With little prospect of any improvement on the horizon, current trade patterns are creating new supply dynamics with the African continent looking like a bulkhead between east and west. Nevertheless, carriers are reporting cargo supply is currently stable and the indicators point to a positive outlook.

“The oil and gas sector appears to be finally delivering projects that have long been forecast and in particular the heavy lifters are being well utilized performing work they were built for and not trawling for break bulk. Rising optimism for wind cargo demand is returning,” said the report.

Moreover, the newbuilding orderbook is starting to bulk out, said the MSI, Spliethoff’s recent decision to order up to 10 28,600 dwt multipurpose vessels continuing a trend for much larger vessels in owner/operator fleets. “Pure operators (who are largely trampers) have yet to see tonnage suppliers commit to supporting future supply in what should be a concern especially as the regulatory net will tighten on less environmentally efficient vessels in the future,” added the report, noting that continuing pressures around financing and high prices at yards is showing no sign of dissipating soon.

The MSI forecast for Q1 2025 is for another step up to 55.4. “Current sentiment reflects the wider economic ambiance and traditionally Q4 is the most active period of the year so the forecast is well supported,” said the analyst.

In terms of regional breakdown, the index showed that optimism among the Americas market has swung sharply upward while respondents from Europe and Asia have ticked downward. “Sentiment among European carriers has always, and continues to be, the least volatile and most range-bound market. Asia carriers have consistently reported slightly bearish sentiment but the gap to the MSI has been closing all year and is now at its narrowest since the end of 2021 reflecting perhaps the lagging dynamic of a slower return of vessels to the Asia region,” said the MSI.

Despite carrier comments suggesting good cargo choices out of Europe presently, a sense of a captive fleet prevails. The Suez canal through which short sea operators have long served the middle east is pooling more vessels in European / Med waters and competitive conditions for some general break bulk is taking some of the shine off European sentiment.

Looking further ahead, the one year MSI forecast to Q3 2025 has slipped back slightly to 55.4, down from 55.7. “Whilst current optimism among Asia carriers continues to improve, a lower one year forecast has been posted for the first time in the last 12 months sufficient to drag the overall forecast back a few tenths,” said the analyst. “Nevertheless the forecast for a year ahead remains elevated and optimistic posting a figure over 55 for the 3rd time in a row. Forecasts for the regions in upcoming editions point to a sharply more optimistic Europe supported by an improving outlook for both Americas and Asia.”

In terms of fleet supply, the MSI indicates that the short- term picture is diverging from the longer term one. In the short term supply is said to be falling, which concurs with the short-term operational index which has been rising in much the same proportion.

The 12 month supply reading has been trending upwards for more than a year signalling an expectation of increasing supply and lower demand. “But with sentiment still

firm and comments indicating stable cargo supply it suggests that incoming newbuildings, some of which have already started appearing - adding dwt supply

to the fleet - could outpace demand growth,” said the index. “The one year MSI forecast has receded marginally in this edition and the fleet supply readings are generally reflective of the supply and demand liquidity balance.”