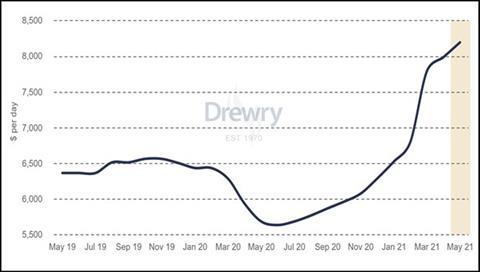

The Drewry Multipurpose Time Charter Index rose to USD7,992 per day in April 2021, representing a rise of 2.5 percent compared March 2021.

Over the year to April 2021, Drewry’s index is up 35 percent, and the analyst expects a further rise of 2.6 percent to reach USD8,200 per day in May.

Drewry said that rates for the larger deadweight tonnage sectors continued to rise over April, albeit at a much slower rate compared with March. The analyst explained that this was mainly due to a slowing in activity, as most carriers reported being fixed through to June. However, there were some outlier rates for the few spot vessels available.

Meanwhile, the smaller shortsea vessel market held steady over the month as supply mostly balanced demand and rates remained firm.

Drewry said: “While we remain optimistic for the longer term outlook for the sector, there are some downside risks for the shorter term, not least Covid-19 related restrictions being imposed in India and Japan and the ongoing issues in Mozambique. Both of these could cause some disruption to the oil and gas sector in the medium term and consequently project cargo demand.”